By now, you have probably heard about the different emergency relief benefits the government is offering, including the COVID-19 stimulus check and food assistance programs. In this blog post, we will explain how immigration status affects your eligibility for these programs.

Your eligibility for federal benefits often depends on whether you have a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN). SSN is given out to individuals with American citizenship, permanent residency, or work authorization that allows them to work in the United States. ITIN, on the other hand, is given to individuals who pay income taxes to the United States government but do not qualify for SSN, including undocumented workers.

Unfortunately, only residents living in the U.S. with a valid SSN can receive the stimulus check.

To be eligible for the stimulus check, you need to have a valid SSN. If you are married and file your taxes jointly, you must both have an SSN to qualify (i.e. if you have an SSN but your spouse has an ITIN, you will not receive the stimulus check). The only exception to this rule is if one or both spouses served in the military within the last year - if this is the case, you can receive the stimulus check even if you both have ITINs.

DACA and TPS applicants are eligible as long as they have work authorization and an SSN. If you are a dreamer, make sure to be on the lookout for the rebate.

If you have not filed your taxes yet for this year, the IRS will look at last year’s taxes. If you did not file last year either, but you receive social security and/or other benefits, you should still qualify for the rebate.

The amount you are eligible for depends on your income level, and will not affect your ability to receive other government benefits.

The maximum payment is $1,200 for an individual, $2,400 for a couple, and $500 for a child. Individuals with an income under $75,000 and married couples with an income under $150,000 qualify for the full amount. If your income exceeds this, the amount you receive is reduced.

The stimulus check is not taxable income, and it will not be counted as income when calculating your eligibility for benefits like TANF, SNAP, and Medicaid.

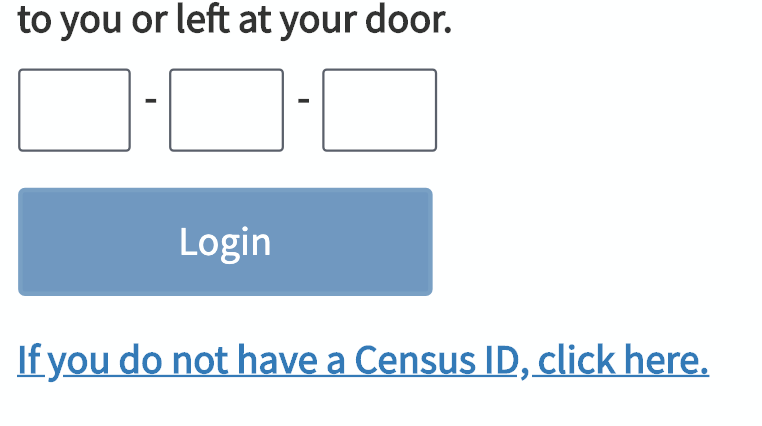

Need more help? The IRS operates centers that can help you navigate this process.

The VITA program offers free tax help to individuals with an income of less than $56,000, individuals with disabilities, or individuals with limited English proficiency. There are three places in New York City, which you can find here.

While SNAP is only available to documented residents, several food assistance programs do not look at immigration status.

For example, food pantries, child nutrition programs, school meals, and WIC do not have immigration requirements and will not ask to see your identification. You can check out our earlier article about food pantries here to find out where you can locate them.

There are two food assistance programs that people can use during the COVID-19 crisis: Pandemic EBT (P-BET) and Disaster Supplemental Nutrition Assistance Program (D-SNAP). P-EBT, which provides an EBT card, offers nutritional resources to families losing access to free/reduced-price school meals. D-SNAP provides replacement benefits for households that qualify for SNAP and lost food due to a natural disaster like COVID-19. D-SNAP does not have immigration restrictions.

P-EBT is not considered in a public charge test. If you need an explanation of what a public charge test is, please refer to our blog post, “Examining 'Public Charge' & how it relates to seeking COVID-19 treatment."

_

This article was co-written by DeYan McCarthy and Lucy Nuttall.